The Office Sector Failing To Keep Up With Business Growth

Mar 15 2018

Darren Best

The UK has recently witnessed a boom of the so-called micro-homes, with the British families living in the smallest homes in Europe by floorspace. To find out whether the “micro-trend” has taken root in the office sector as well, Savoy Stewart decided to investigate office floorspace available relative to the number of businesses in England and Wales.

Official Stats Suggest: The Office Sector Mostly Stagnating

Analysing the latest data on business floorspace from the Valuation Office Agency, Savoy Stewart noticed that from 2012 to 2016, the total office floorspace in England and Wales grew from 88,981 square metres to 89,037 square metres which is equivalent to 0.06%. While some regions - most notably Wales (2.2%) - significantly exceeded this rate of growth, other regions such as the South East (-1.5%) and the East of England (-1.2%) experienced a decline in office floorspace available. A similar trend was also observed on a local level; where there was growth of office floorspace, it was minimal. It can thus be concluded that except for the UK capital and a few office sector hotspots outside London, the office sector has been stagnating. When compared to business growth, the stagnation becomes even more dramatic.

Photo credit: ImageFlow/Shutterstock

Photo credit: ImageFlow/Shutterstock

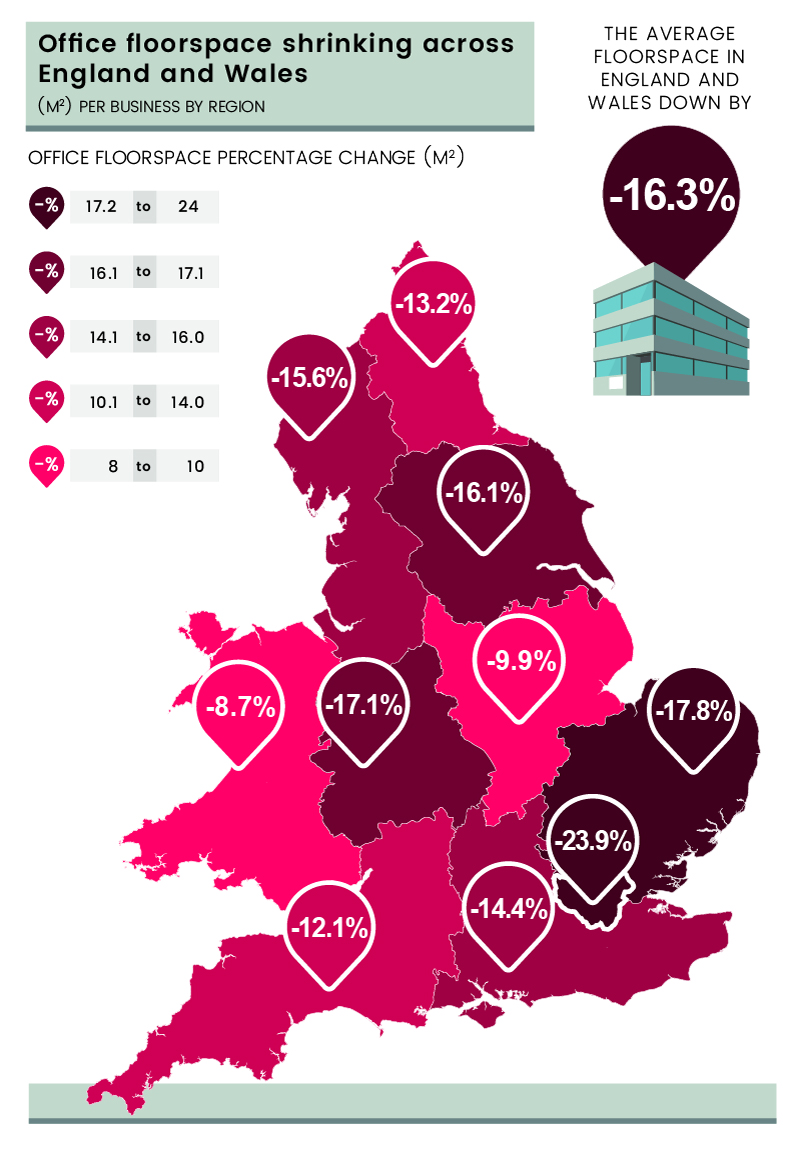

Office Floorspace per Business Shrinking Across England and Wales

To find out whether the trend in the office sector correlates to business growth, Savoy Stewart has analysed official stats on business demography, focusing on growth of active businesses in England and Wales from 2012 to 2016. It must be noted that not all active businesses need to buy or rent office space, but considering that the service sector is dominating the UK economy and contributing as much as 79% of the country’s GDP, the data used provides a reasonable estimate of the office floorspace area available per business.

When evaluating the office sector floorspace available per business in England and Wales, Savoy Stewart found that the trend has been negative in all regions. Despite a significant growth in office floorspace over the last decade (5.3%), London experienced the most dramatic decline in office floorspace available per business. From 2012 to 2016, office floor space in London per business fell from 58.7m2 to 44.7m2, which is equivalent to a decrease of 23.9%.

However, London is second only to the North East (46.8m2 per business) when it comes to the average size of office space per business. After London, the most significant decrease in office floorspace available per business was observed in the North of England (-17.8%), followed by the West Midlands (-17.1%), and Yorkshire and the Humber (-16.1%). The negative trend was the least dramatic in Wales (-8.7%), followed by the East Midlands (-9.9%) and the South West (-12.1%).

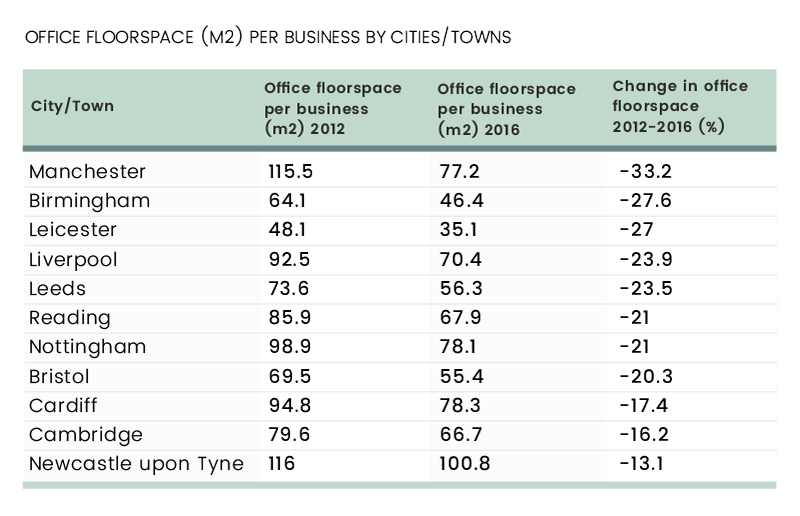

Substantial Decrease in Office Floorspace per Business Also Observed on Local Level

Savoy Stewart also analysed the change in office sector floorspace relative to business growth in major cities and towns across England and Wales. The results reveal that, just like on the regional level, the trend was negative on the level of cities and towns as well. The most dramatic decrease was observed in Manchester where office floorspace available per business shrunk by a staggering 33.2%.

Despite that, ‘the capital of the North’ has some of the most spacious offices in England (77.2m2 per business), falling behind Newcastle upon Tyne which offers an amazing 100.8m2 of office floorspace per business. After Manchester, office floorspace per business shrunk the most in Birmingham (-27.6%), followed by Leicester (-27%), Liverpool (-23.9%) and Leeds (-23.5%). Despite having the most spacious offices in the country in 2016, Newcastle upon Tyne also saw a decline in floorspace per business, but the observed decline was the lowest of all analysed cities and towns: -13.1%. After Newcastle upon Tyne, office floorspace per business shrunk the least in Cambridge (-16.2%), followed by the Welsh capital of Cardiff (-17.4%) and Bristol (-20.3%).

Darren Best from Savoy Stewart commented:

“The results of the research don’t necessarily suggest that offices in England and Wales have physically become smaller, although there has probably been some downsizing in floorspace. Nevertheless, the overall negative trend in office sector floorspace available relative to the number of businesses is very concerning because it suggests that the office sector is failing to keep up with business growth. And if such a trend will continue, I can see only one possible outcome – lack of offices and consequently, a substantial increase in prices no matter if a business is seeking to rent or buy.”