Creative Industries: The Regional Office Space Take-Up

Oct 26 2017

Darren Best

The role of the creative industry has experienced a revival over the past few years. A major power player in 2017, creative businesses are predominantly small, highly diverse and niche – ranging from fin-tech, to fashion technology and virtual reality.

“The UK is a global leader in the creative industries. Contributing factors to this success are its connectivity, language, political and legal structures, financial infrastructure, existing business clusters, openness to global companies and access to worldwide talent. It has been a dominant player in the European tech boom.” – ‘Creative Regions’ – CBRE

In 2017, the industry has become an important part of major commercial office markets. Fuelled by the addition of thousands of new jobs in the last three years, the creative sector has had no choice but to increase its share of UK office space (outside of London), from 9% in 2013, to 15% in 2015-16 – contributing an average 1 million sq. ft. annually in the South East and core regional cities alone.

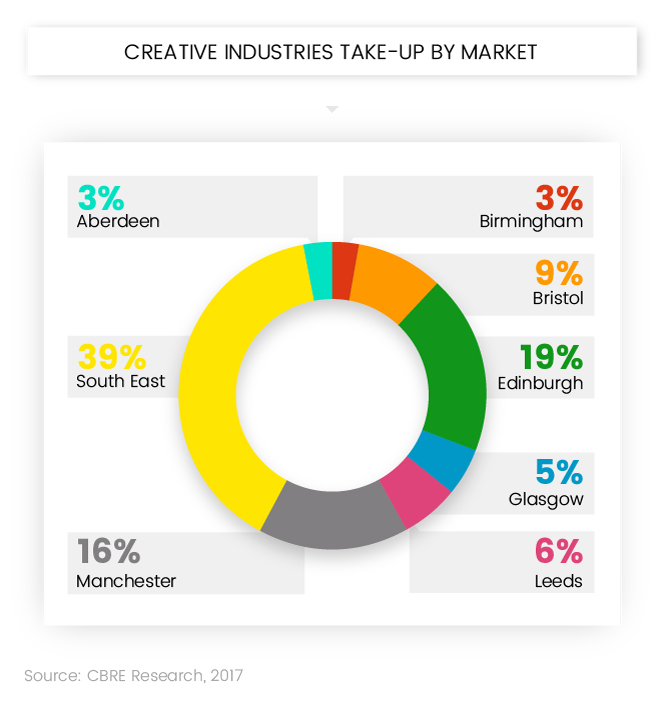

In the visual infographic designed by Savoy Stewart, we can see that the three most popular areas for commercial property take-up by creative sectors are the South East, Edinburgh and Manchester. Highlighting, contrary to consensus, creative companies of this type are not restricted to London but can be found organically forming in every corner of the UK.

The Influence of the Millennial Market

Recent research reveals a notable characteristic of creative talent markets can be found among ‘Millennials’ in their workforce's – with Manchester, Birmingham and Glasgow currently holding the highest numbers of young, emerging millennials thirsty to work for a company that reflects their vision.

Image credit: Dan Highton/Shutterstock

With eager creative employer’s keen to attract fresh talent – talent which may help to sustain a business in today’s tumultuous climate – the importance of location and style has perhaps never been more fruitful. Certainly, considerations such as ‘where do millennials want to live and work’ and ‘what role does property play in their lives and expectations’ will remain critical for employers, property developers and investors. After all, through an in-depth understanding of the unique characteristics and potential of this market, creative businesses, investors and developers will be better placed to make effective, cost efficient and informed property decisions that will greatly aid the quest to remain competitive. Fittingly, Savoystewart.co.uk analysed a report conducted by CBRE and selected 6 of the top points to illustrate what it is millennials really want from their work environment:

- 75% want to work in a city or large town location.

- A third would be happy working in a business park or campus environment.

- 50% said they would not be willing to spend more than 30 minutes travelling to work.

- A desire for collaborative and communal space, with fluid layouts, was a reoccurring theme.

- An office with stimulating design voted most likely to have a positive impact on work productivity and experience.

- Proximity to a range of external amenities, such as museums, galleries and cafés considered a high priority.

In terms of style, millennials also value innovative, enriching ‘non-corporate’ spaces – with features such as exposed services and brick work, which not only appeal to a young workforce but can reflect a brands modern identity. Buildings with history and noteworthy architecture, such as warehouses and old retail premises, are becoming increasingly popular and valuable for this reason.

Image credit: Monkey Business Images/Shutterstock

Forward thinking employers have caught on to these desires and a great deal of ‘agile’ or ‘activity-based’ workspaces have emerged in recent years, as a result. Of course, depending on size, business focus and cost, creative companies will all have different push and pull factors that determine their office location and style choices. Factors such as proximity to clients, transport links and clustering possibilities are all integral to deciding where to take-up office space. But what is true to say is that today, commercial property style and ease of fluidity are becoming top consideration contenders.

Strategy Tips for Commercial Landlords

- Take time to review the type of office space needed to attract creative industry occupiers.

- Consider shorter leases to allow for greater levels of flexibility for smaller business and start-ups to scale up or down quickly as required.

- Design offices with ‘built-in’ collaboration/co-working areas – depending on size, and providing choice of work environments for the individual.

- Create a management regime that fosters community and networking events for occupiers to connect and share expertise.

The creative sector in the UK has seen great success in recent years and shows no sign of slowing. Expected to grow well into the foreseeable future, creative industries will ignite the popularity of collaborative, co-working, incubator and accelerator office spaces – and it would be remiss for commercial property specialists not to take advantage. As, an extract from CBRE ‘Creative Regions’ reads:

“Expansion of the global creative economy will bring increased international competition to the UK, both from traditional competitors like North America and Europe, as well as new sector rivals in fast growing economies whose governments also back development of their creative industries. To meet this challenge the choice of office space and where to locate will be ever more critical to the sustainability, competitiveness and future growth of UK creative companies.”